This article is based on insights from our white paper Unified risk modeling for utility resilience. Click here to download the paper and learn more about how to overcome the most common struggles with effective risk management.

The traditional approach to utility risk management often focuses on isolated issues—specific assets, regions, or regulatory requirements. While these efforts offer some visibility, they leave major gaps that can compromise reliability, safety, and resilience over time.

As climate-driven risks, aging infrastructure, and evolving energy demands increase the complexity of utility operations, a siloed view is no longer enough. Utilities need an integrated approach to risk modeling that aligns data, departments, and decisions across the entire enterprise.

Unified risk modeling provides that foundation.

Article continues below.

Why unified risk modeling matters

As utilities face increasingly complex operational and environmental challenges, a unified approach to risk modeling is essential for delivering accurate insights, aligning decision making, and strengthening grid resilience.

Risk modeling is only as effective as the quality of the data and the consistency of the frameworks that support it. Utilities today face not only the technical challenge of predicting risks but also the organizational complexity of aligning assessments across assets, business groups, and environmental factors. In the energy sector, climate change, aging infrastructure, and uncertainty introduce new vulnerabilities for energy systems, requiring robust risk modeling to address these evolving threats.

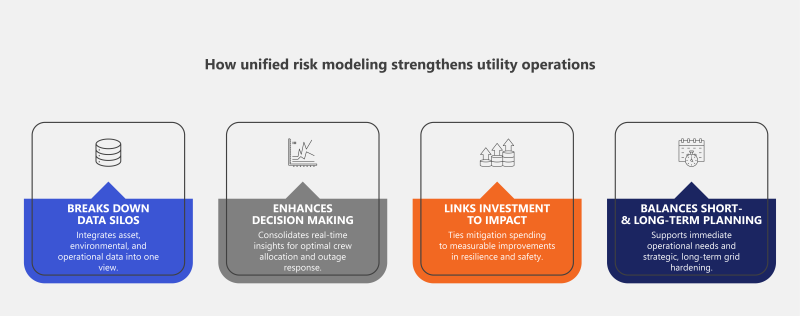

A unified approach delivers critical advantages, enabling utilities to:

Break down silos and create a shared risk framework

By integrating asset data, environmental conditions, and operational metrics into a single platform, unified modeling eliminates blind spots and ensures all teams operate from a consistent, up-to-date view.

Enhance situational awareness for better operational decision making

Unified dashboards that consolidate cross-departmental insights allow utilities to anticipate failures, allocate crews more effectively, and maintain service reliability—especially during extreme weather events. Predictive analytics and machine learning enable utilities to predict failures, optimize resource allocation, and deliver more reliable service to customers by prioritizing maintenance and minimizing disruptions.

These dashboards serve as a comprehensive report, consolidating real-time and historical data to provide a thorough analysis of system conditions, asset health, and exposure to environmental risks. This analysis supports operational decision making by identifying hazards, evaluating risks, and informing resource deployment strategies.

Link investments to measurable outcomes

Frameworks like risk-spend efficiency (RSE) enable utilities to tie mitigation dollars directly to improvements in safety, reliability, and regulatory compliance, strengthening the business case for resilience investments.

Balance short-term needs with long-term resilience planning

A unified model enables both immediate risk forecasting—such as during a high-wind event—and strategic planning based on trends like climate-driven infrastructure wear.

From reactive to proactive risk management

Historically, many risk models have been reactive—responding to outages or asset failures after they occur. Unified risk modeling shifts this dynamic by applying predictive intelligence, enabling utilities to:

- Detect subtle emerging risks across vegetation, asset health, and environmental factors

- Prioritize maintenance and inspections based on real-time risk assessments

- Support long-term investment strategies that strengthen grid resilience over decades, not just months

By connecting real-time operational needs with future planning, utilities can move from a reactive cycle of disruption and repair to a proactive approach that safeguards infrastructure and communities.

What’s next in the series

In the next article, we’ll explore the key use cases for unified risk modeling—including wildfire mitigation, vegetation management, and infrastructure investment planning.