11-minute read

Quick summary: Learn how U.S. businesses can navigate the complexities of GDPR compliance to protect personal data, mitigate risks, and build trust with EU customers.

The General Data Protection Regulation (GDPR) has fundamentally reshaped how organizations worldwide manage and protect personal data. Enacted by the European Union in 2018, GDPR established strict guidelines for data privacy and security, placing the rights of individuals at the forefront. The regulation’s extraterritorial scope applies to any organization processing the personal data of EU residents, regardless of its location.

Businesses without a physical presence in Europe may fall under GDPR’s jurisdiction if they offer goods or services to EU residents or monitor their online behavior. This expansive reach underscores the importance of GDPR compliance, as penalties for violations can reach up to €20 million or 4 percent of global annual revenue, whichever is higher. Beyond the risk of fines, non-compliance can result in reputational damage and a loss of trust from customers and stakeholders.

By embedding GDPR compliance principles into operations, organizations can achieve more robust data governance while demonstrating a commitment to data privacy and security. This approach not only supports legal compliance, but also strengthens competitive positioning in an increasingly privacy-conscious marketplace. This guide explores the essential aspects of GDPR compliance for U.S.-based businesses, providing insights into key principles, obligations, and strategies for alignment.

Key principles of GDPR

GDPR is built on a foundation of principles that guide how personal data should be handled. These principles ensure that data processing is conducted responsibly, transparently, and with respect for individual rights.

Lawfulness, fairness, and transparency

Data must be processed in a manner that is lawful and fair, and individuals must be informed clearly about how their data is being used. Transparency ensures that individuals are aware of their rights and of how their personal information is being handled.

Purpose limitation

Personal data should only be collected for specific, legitimate purposes and must not be further processed in ways that are incompatible with those purposes. This principle restricts organizations from repurposing data without proper justification or consent.

Data minimization

Data collection should be limited to what is necessary for the intended purpose. Excessive or irrelevant data collection not only violates GDPR, but also increases security risks.

Accuracy

Organizations must take steps to ensure that personal data remains accurate and up to date. Inaccurate or outdated data must be corrected or deleted promptly to maintain GDPR compliance.

Storage limitation

Personal data should not be retained longer than necessary for the purposes for which it was collected. Organizations are required to establish and adhere to retention schedules to avoid retaining data indefinitely.

Integrity and confidentiality

Organizations must implement appropriate technical and organizational measures to secure personal data against unauthorized access, accidental loss, or damage. This includes encryption, access controls, and regular security assessments.

Article continues below.

Compliance as a Service (CaaS) ebook

Get expert insights on how to hit the mark with scalable compliance operations.

We will never sell your data. View our privacy policy here.

Understanding personal data under GDPR

Personal data is at the core of GDPR, and understanding its scope is essential for compliance. GDPR defines personal data broadly, covering any information related to an identified or identifiable natural person. This includes a wide range of identifiers that may not be traditionally considered sensitive in some jurisdictions.

Under GDPR, personal data encompasses:

- Direct identifiers such as names, photos, email addresses, phone numbers, and physical addresses

- Financial information, including bank account details and credit card numbers

- Online identifiers such as IP addresses, cookie data, and device identifiers

- Medical and health-related information, genetic data, and biometric data

- Data shared on social media platforms, which may reveal personal or behavioral insights

This broad definition reflects GDPR’s comprehensive approach to safeguarding individual privacy in the digital age.

By comparison, the U.S. concept of personally identifiable information (PII) is narrower in scope. PII typically includes information that can directly identify an individual, such as names, Social Security numbers, or financial account numbers. However, it may not encompass certain indirect identifiers, like IP addresses or behavioral data, unless they are explicitly linked to an individual.

The differences in these definitions highlight the need for U.S. businesses to adjust their data protection frameworks to align with GDPR’s broader standards. This requires a more inclusive view of what constitutes personal data and underscores the importance of careful handling, even for seemingly innocuous information.

Rights of data subjects

GDPR places significant emphasis on empowering individuals to control their personal data. These rights, referred to as data subject rights, ensure transparency and accountability in data processing while giving individuals the ability to manage how their information is used.

Right to access

Individuals have the right to request access to their personal data held by an organization. This includes information on the data being processed, the purposes of the processing, and whether the data has been shared with third parties. Organizations must respond to access requests within one month and provide the requested information in a clear, accessible format.

Right to rectification

If personal data is inaccurate or incomplete, individuals can request corrections. Organizations must update the data promptly and notify the individual once the changes have been made.

Right to erasure (“right to be forgotten”)

Individuals can request the deletion of their personal data under specific circumstances, such as when the data is no longer necessary for the purposes it was collected or if the individual withdraws their consent. While this right is not absolute, it places a clear obligation on organizations to justify retaining the data.

Right to restrict processing

In cases where individuals contest the accuracy of their data or object to its processing, they can request that the organization temporarily restrict its use. During this period, data may still be stored but cannot be used for processing activities unless consent is obtained.

Right to data portability

This right allows individuals to receive their personal data in a structured, commonly used, and machine-readable format and transfer it to another controller. It promotes flexibility and user empowerment, particularly in contexts like switching service providers.

Right to object

Individuals can object to the processing of their personal data in certain circumstances, such as direct marketing. If an objection is raised, organizations must cease the processing unless they can demonstrate compelling legitimate grounds that override the individual’s interests, rights, and freedoms.

Obligations for U.S. businesses

Although GDPR is a European regulation, its requirements apply to many U.S.-based businesses that handle personal data of EU residents. Understanding and addressing these obligations is critical for maintaining GDPR compliance and avoiding significant penalties.

Determining applicability

U.S. businesses must first assess whether GDPR applies to their operations. The regulation governs any organization offering goods or services to EU residents, whether paid or free, or monitoring the behavior of individuals within the EU. Examples of monitoring include tracking online activities through cookies or analyzing browsing behavior for targeted advertising. A thorough evaluation of business activities ensures clarity on GDPR compliance requirements.

Implementing data protection measures

GDPR compliance requires organizations to adopt appropriate technical and organizational measures to protect personal data. These include implementing encryption, access controls, regular vulnerability assessments, and incident response plans. Businesses must ensure that data protection measures are not only robust, but also scalable as the organization grows.

Appointing a Data Protection Officer (DPO) when necessary

Under certain conditions, businesses must designate a DPO to oversee data protection strategies and ensure GDPR compliance. This applies when an organization processes sensitive data, engages in large-scale monitoring of individuals, or handles data as a core activity. The DPO acts as a liaison between the organization and data protection authorities, providing guidance and monitoring compliance efforts.

Ensuring lawful data transfers

For U.S. businesses transferring personal data from the EU, GDPR mandates the use of mechanisms to ensure lawful cross-border data flows. Common solutions include Standard Contractual Clauses (SCCs), Binding Corporate Rules (BCRs), or adherence to recognized frameworks like the EU-U.S. Data Privacy Framework (if applicable). These measures establish clear safeguards to protect data when it moves outside EU jurisdiction.

GDPR’s impact on mergers and acquisitions

Mergers and acquisitions introduce unique challenges under GDPR, particularly when transactions involve companies handling personal data of EU residents. The regulation’s stringent requirements and high penalties for non-compliance necessitate careful evaluation during the due diligence process.

Assessing GDPR compliance during due diligence

Identifying potential liabilities in M&A transactions involves reviewing the target company’s GDPR compliance practices, such as data processing activities, records of consent, and mechanisms for handling data subject requests. Key areas of assessment include the organization’s privacy policies, technical safeguards, incident response procedures, and data transfer arrangements. Any gaps in compliance may represent financial, operational, or reputational risks that must be addressed before finalizing the transaction.

Understanding the risks of acquiring non-compliant companies

Violations of GDPR do not dissolve when a company is acquired. Instead, the parent company inherits the compliance obligations and potential liabilities of the acquired entity. Past violations can lead to substantial fines and reputational damage, impacting the value of the transaction and the acquiring organization’s financial health.

Data anonymization and pseudonymization

Under GDPR, protecting personal data is paramount, and techniques like anonymization and pseudonymization play essential roles in achieving compliance. When organizations understand the distinctions between these methods and their appropriate applications, they enable enhanced data security and alignment with regulatory requirements.

Anonymization

Anonymization involves modifying data sets so that no personally identifiable information remains, making it impossible to identify individuals. According to Recital 26 of GDPR, data that has been truly anonymized falls outside the regulation’s scope, as it no longer relates to an identifiable natural person. Thus anonymized data can be used for purposes such as statistical analysis or research without infringing on individual privacy rights. However, achieving true anonymization is challenging, as overly altering data can diminish its utility.

Pseudonymization

Pseudonymization entails replacing personally identifying fields with pseudonyms—random numbers or symbols—to obscure identities. For example, a Social Security Number can be substituted with a randomized identifier. While pseudonymization reduces the linkability of data to an individual, it does not eliminate the possibility of re-identification, especially if additional information is accessible. Therefore, pseudonymized data remains within the purview of GDPR, and appropriate safeguards must be maintained.

Implementing these techniques requires a strategic approach that encompasses:

- Assessing data sensitivity: Evaluate the nature of the data to determine whether anonymization or pseudonymization is more suitable, considering the balance between data utility and privacy protection.

- Applying robust methods: Utilize advanced tools and methodologies to effectively anonymize or pseudonymize data, ensuring that the chosen technique aligns with the intended use and complies with GDPR standards.

- Regularly reviewing and updating practices: Continuously monitor data protection measures to address emerging risks and evolving regulatory requirements, adapting strategies as necessary to maintain GDPR compliance.

When organizations understand the distinctions between anonymization and pseudonymization and their appropriate applications, they uncover new possibilities for enhanced data security and closer alignment with GDPR and other regulatory requirements.

Consequences of non-compliance

Failure to comply with GDPR can have significant consequences, both financially and reputationally, for organizations processing personal data of EU residents. The regulation’s enforcement framework is designed to deter violations and uphold data protection standards across industries.

Potential fines

Organizations can face fines of up to €20 million or 4 percent of their annual global turnover, whichever is higher. Penalties are tiered based on the severity of the violation. For example, failing to obtain proper consent or ignoring data subject rights typically incurs higher fines than administrative oversights.

Reputational damage and loss of consumer trust

Beyond financial penalties, organizations that fail to meet GDPR requirements risk losing consumer trust and damaging their brand reputation. Publicized violations can lead to customer attrition, reduced business opportunities, and a long-lasting negative perception of the company. In an increasingly privacy-conscious marketplace, businesses that demonstrate strong data protection practices are more likely to retain and attract customers.

Examples of enforcement actions

Regulators have enforced GDPR rigorously, holding organizations accountable for a wide range of violations. More recent enforcement actions include:

- Meta Platforms, Inc.: In 2023, Meta (parent company of Facebook) was fined €1.2 billion for improperly transferring EU users’ data to the United States, setting a record for GDPR penalties.

- Uber: In August 2024, Uber received a €290 million fine from the Dutch Data Protection Authority for illegally transferring European drivers’ personal data to the United States.

- LinkedIn: In October 2024, LinkedIn was fined €310 million by Ireland’s Data Protection Commission for processing personal data for advertising without a lawful basis.

Steps toward GDPR compliance

Achieving GDPR compliance is a multifaceted and ongoing process that requires more than implementing a checklist of actions. Compliance demands a holistic approach to data management, accountability, and privacy integration across the organization. The steps outlined below provide a strong foundation for addressing key GDPR requirements, but they represent only the beginning of a broader effort to embed robust data protection practices into every aspect of operations.

Conducting data audits to map data flows and identify processing activities

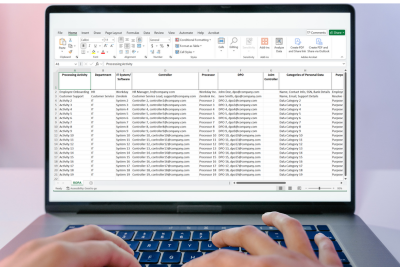

A thorough data audit is the foundation of the GDPR compliance process. Organizations must identify what personal data they collect, how it is processed, where it is stored, and with whom it is shared. Mapping these data flows helps uncover vulnerabilities, clarify processing purposes, and ensure compliance with GDPR principles such as data minimization and purpose limitation. As part of this effort, businesses are required to maintain a Record of Processing Activities (ROPA), which documents all data processing operations and supports regulatory transparency.

Article continues below.

Download a free ROPA template

Streamline GDPR compliance efforts with our free ROPA template, designed to help you efficiently document and manage data processing activities.

We will never sell your data. View our privacy policy here.

Reviewing and updating privacy policies and notices

Privacy policies and notices must clearly explain how personal data is collected, processed, and protected. Organizations should review these documents to ensure they are transparent, easily understandable, and compliant with GDPR requirements. Updates may include detailing data subject rights, specifying legal bases for processing, and disclosing data retention periods.

Implementing procedures for honoring data subject rights

Procedures to address data subject rights requests include mechanisms for granting access to personal data, correcting inaccuracies, deleting data upon valid requests, and transferring data when required. Timely and efficient responses to requests demonstrate commitment to GDPR principles and help avoid regulatory scrutiny.

Training employees on data protection principles and practices

Regular training ensures that staff understand their responsibilities regarding data privacy and security. Training should cover topics such as recognizing personal data, managing access controls, and responding to data breaches. Well-informed employees are better equipped to prevent GDPR compliance lapses.

Regularly monitoring and reviewing data protection measures

GDPR compliance is not a one-time effort. Organizations must establish processes for ongoing monitoring and regular reviews of data protection practices. Periodic audits, updates to policies that reflect changes in processing activities, and staying informed about evolving regulatory requirements are essential components of an effective compliance strategy. Regular improvements to these measures help strengthen compliance and reduce risk.

Achieving GDPR compliance is a multifaceted and ongoing process that demands a holistic approach to data management, accountability, and privacy integration across the organization.

Charting a path to trust and GDPR compliance

GDPR set a global standard for data privacy, serving as a wake-up call for organizations worldwide. For U.S. businesses engaging with EU residents, compliance is not merely a legal obligation—it is a competitive advantage in an era where trust is a cornerstone of consumer relationships. The regulation underscores the critical need to embed privacy at the core of operations, transforming data protection from a reactive measure into a strategic priority.

The journey to GDPR compliance can seem daunting, but it is achievable with a structured and proactive approach. Start by conducting a comprehensive audit of data practices, then prioritize building a culture of privacy across all levels of the organization. Engage experts, invest in training, and leverage technology to ensure data governance frameworks are robust and scalable.

Ultimately, GDPR compliance is more than a checklist—it is a commitment to transparency, accountability, and the responsible use of data. By adopting this mindset, businesses not only reduce risk but also foster deeper trust with customers, partners, and stakeholders. Organizations that view compliance as an opportunity rather than a burden will be well-positioned to navigate the evolving regulatory landscape and thrive in a privacy-first world.

Streamline compliance with expert guidance

- Compliance managed services

- Compliance process optimization

- Regulatory response readiness

- Compliance automation