8-minute read

Quick summary: The 45V clean hydrogen production credit makes clean hydrogen more attractive to investors by providing credits for low-carbon hydrogen production; however, emissions reporting for credit acceptance will be crucial for asset managers.

Development of smart clean-energy assets can be challenging due to the uncertain nature of certain investments and the vague nature of new financial incentives. For developers and asset managers, understanding which financial incentives are available and how they work is extremely important, especially the clean hydrogen sector, where cost is one of the most prohibitive factors to deployment.

The Inflation Reduction Act (IRA) has been one of the most influential clean-energy policy initiatives to pass in the last few decades. It has had far-reaching consequences on many distinct aspects of the clean energy landscape, one of those being clean hydrogen.

Section 45V of the Inflation Reduction Act introduces the Clean Hydrogen Production Credit, designed to incentivize the production of clean hydrogen. This production tax credit (PTC) aims to support the transition to a low-carbon economy by promoting hydrogen as a clean energy source. By providing financial incentives, Section 45V seeks to accelerate the development and deployment of clean hydrogen technologies, contributing to the broader goals of reducing greenhouse gas emissions and combating climate change.

Further understanding how 45V affects current projects and the coming landscape of hydrogen economies in the United States is critical to meet decarbonization goals and hydrogen development goals. This article examines the framework of 45V for guiding current hydrogen production assets and shaping the direction for successful hydrogen implementation into the clean energy future.

Article continues below.

WEBINAR

Challenges Controlling Renewable Generation in a Green Hydrogen Complex

What is the Section 45V hydrogen credit?

PTCs for hydrogen development will allow clean hydrogen projects to grow demand through cheaper production methods and offset high starting costs. The section is part of a broader movement to strengthen the U.S. hydrogen economy by developing regional hydrogen hubs and providing financial incentives to producing clean hydrogen. Projects targeting the credit will provide the well-to-gate emissions of the hydrogen production and receive scaling credit amounts based on the carbon intensity of the hydrogen.

Table 1: Section 45V credit amounts (source)

| Credit amount | Well-to-gate emissions |

| $3/kg H2 | <0.45 kg CO2e |

| $1/kg H2 | 0.45 -1.5 kg CO2e |

| $0.75/kg H2 | 1.5 – 2.5 kg CO2e |

| $0.60/kg H2 | 2.5 – 4.5 kg CO2e |

“Well-to-gate emissions” refers to all emissions that are captured upstream of the hydrogen process before it exists the facility. This includes all emissions associated with raw material extraction for the hydrogen (ex: feedstock growth) and the collection and transport of the material to the hydrogen production facility. Emissions at the facility are also considered, and the timer stops only once the hydrogen leaves the facility and exits the “gate” of the production factory.

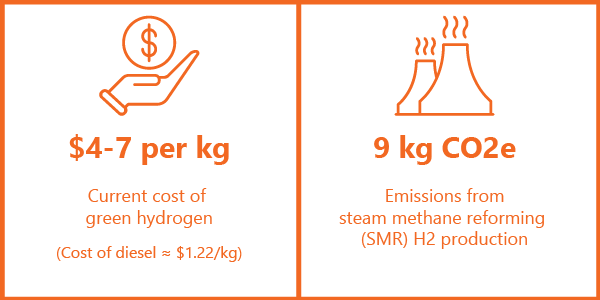

To put these numbers into perspective, the allocation of the full $3 credit would be over half of what the current average green hydrogen cost is in the United States.

However, understanding the scope and importance of 45V requires taking a step back, and looking at the bigger story of carbon emissions reporting and the coming need for clearer regulations and standardized data processing.

Emissions reporting for the new clean energy world

One of the burgeoning industries in the energy and clean energy asset environment is emissions reporting. Many countries are adopting policies that use financial incentives to drive energy markets away from natural gas and coal with programs like carbon taxes and energy subsidies, mostly based on the carbon intensity of an energy source or production facility.

Current methods for emissions accounting vary widely in scope and scrutiny. High-level emissions reports of carbon estimates offer very different numbers from focused, detailed reporting of specific carbon intensity of business practices. This means the level of detail with which companies choose to (or are required to) report emissions can drastically change their carbon intensity, further exacerbated by varying company sizes creating larger differences in emissions in general.

There are three levels of emissions that companies typically track:

- Scope 1 covers direct emissions from owned or controlled sources.

- Scope 2 includes indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company.

- Scope 3 encompasses all other indirect emissions that occur in a company’s value chain.

Both the EPA and the SEC currently have regulations in place for measuring and reporting emissions. In early 2024, the SEC adopted climate disclosure rules for how public companies make carbon offset and renewable energy credit (RECs) activities available to investors. From an emission reporting standpoint, registrants must now follow more stringent rules:

- Large accelerated filers (LAFs) and accelerated filers (AFs) that are not otherwise exempted must report information about material Scope 1 emissions and/or Scope 2 emissions.

- Those required to disclose Scope 1 and/or Scope 2 emissions must provide an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level.

This is a step in the right direction, but these watered-down regulations represent only small steps towards an emission reporting industry that is becoming increasingly important with higher-value financial incentives. Not to mention that these rules only affect public companies, and the regulatory process for smaller companies lags far behind.

For the 45V credit, one method taxpayers must use is the 45VH2-GREET model for emissions calculations, a tool adopted by the U.S. Department of the Treasury to streamline the process for credit allocation determination. A mixture of fixed assumptions and user inputs is used to allocate all well-to-gate emissions associated with the hydrogen produced, and these emissions values are used to determine credit amounts.

The role of energy attribute certificates (EACs)

With the increased scrutiny of life-cycle electricity generating reports, it is important for asset managers to work with established entities to track emissions for 45V credit acceptance. Each vendor in a power market submits claims about the amount of power used and where that electricity came from, in the form of an EAC that is procured and retired by accredited groups. For compliance under certain policies, having a way to track and substantiate these claims is necessary to avoid double-counting or malpractice with clean energy reporting metrics. EACs are taking on increased power as they can strengthen credibility about a project’s energy metrics and allow for smoother matching of financial credits to project developers.

One major problem with tracking emissions is the complex nature of blended power supplies in a larger grid. If a hydrogen production plant is purchasing power from the grid, it can be extremely difficult to track exactly where each kilowatt of energy came from and where it was generated. With modern grids having a variety of energy sources and many interconnections, how are facilities able to determine what percentage of power was produced by green sources or by polluting sources? EACs are tools that carry information about a unit of energy, tracking the energy and emissions associated with that specific unit.

While the U.S. Treasury and IRS have initially approved the use of EACs to document emissions tracking, there are certain limitations on which EACs meet the regulatory requirements. The current philosophy is that each procured and retired EAC will be substantiated and credited on a one-to-one basis to resolve carbon intensity of the hydrogen produced at a facility.

The compliance and reporting accuracy of EACs can help clean hydrogen developers by creating a clear pathway for 45V acceptance. But they must also comply with strict requirements referred to as the “three pillars”—three specific guidelines that an EAC must fall within to be properly accepted on behalf of a taxpayer.

Three “pillars” of EACs

Incrementality

EACs satisfy the incrementality requirement in two ways:

- The first is if the hydrogen production facility is in service within 36 months after the corresponding power generation project is in commercial operation.

- The second is if said power generation project had an increase in rated nameplate capacity less than 36 months before the production plant began service.

Newer generating facilities use the newest and best techniques for minimizing emissions, so requiring EACs to satisfy these conditions minimizes the chance of unintended GHG emission increases from increased hydrogen production plans.

The U.S. Treasury and IRS are currently taking requests for options to expand the scope of the incrementality requirements.

Temporal matching

Until 2028, the electricity within the EAC must be generated in the same year that the taxpayer’s hydrogen is produced. This is further strengthening by the DOE to encourage the use of newer and cleaner generation sources and avoid increased emissions by larger electrolyzer loads from hydrogen plants.

After 2028, the matching requirement becomes stricter, with electricity needing to be generated in the same month as the retired EAC. For the three-pillars approach to help decrease emissions through development of clean hydrogen, strict rules must be followed to regulate new facilities and ensure compliance with carbon negative policy goals. However, rules that are too strict will result in a lack of development. Flexibility and close guidance under the temporal matching requirement will be key to future healthy hydrogen production economies across the United States.

Deliverability

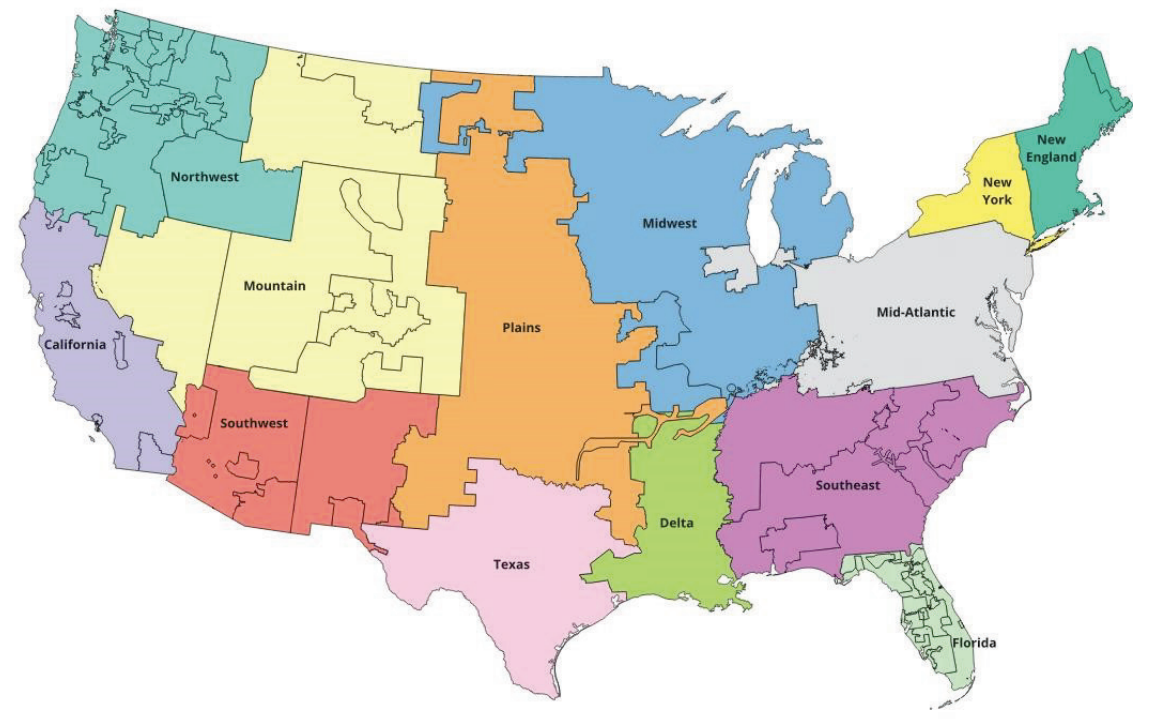

The third and final pillar requires the energy generated to produce hydrogen to be in the same geographic region as the production facility. This both simplifies the electrical tracking processing quite a bit and promotes the use of regional clean energy centers for each hydrogen production plant.

Figure 2: Regional ISO map for EAC matching (source)

An emerging market that will set the tone for other energy paradigm shifts

To meet lofty hydrogen goals set by the United States and other countries, the price of clean hydrogen needs to compete with current alternative fuel costs like diesel. The 45V hydrogen credit is a step towards accelerating the cost decrease for manufacturing centers and can help incentivize larger investments into hydrogen production. Facilitating a movement towards clean hydrogen will require years of work towards establishing infrastructure and building momentum with multi-faceted project types.

Growth in the hydrogen market needs to be developed intelligently to prevent it from backfiring with increased emissions and high energy costs for consumers. Exponential growth in hydrogen production without oversight could create scenarios where the increase in energy demand leads to short-term increases in carbon emissions. The three-pillars approach will be watched closely by many in the energy field to see whether it can thread the needle between necessary large-scale growth and a market that could quickly become a stain on the energy transition it is trying to help.

Production is only one step, however, and offtake agreements are also necessary to complete the puzzle between increased production and increased use of hydrogen. 45V will push project developments into clean hydrogen production facilities, but these facilities cannot become mature assets until secure offtake agreements are also in place to use this hydrogen.

The 45V PTC offered to hydrogen asset developers will be crucial in accelerating the penetration of hydrogen into the market and will see development into emissions tracking guidelines that could set the future for many other energy sectors.

Powering a sustainable tomorrow

We partner with utilities to help them build a more resilient grid and move towards a cleaner, brighter future through

- Smart automation

- Asset image analytics

- DERMS implementation

- Analytics & predictive insights

- Cloud optimization